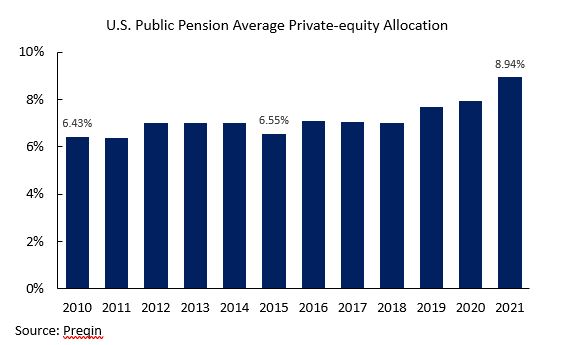

In an article written by Heather Gillers, titled, “Retirement Funds Bet Bigger on Private Equity,” the author describes how U.S. retirement and pension funds have increased asset allocation to private equity funds, reaching an average of 8.9% of pension funds’ investments in 2021. Equating to approximately $480 billion of state and local pension fund assets in 2021, a $180 billion increase from 2018.

Despite the increased costs associated with private equity, this tide shift is expected to continue, and can be further illustrated by some of the U.S.’s largest pension funds - $500 billion California Public Employees’ Retirement System and $75 billion Los Angeles County Employees Retirement Association – dramatically increasing their allocation to private equity, raising their targets from 8% of holdings to 13%, and 10% of holdings to 17%, respectively.

“In the next five to 10 years you’re going to see notably bigger private asset allocations across these institutions,” stated Steve Foresti, Chief Investment Officer at Wilshire, a private investment firm that provides its services to primarily individuals, pension, and profit sharing plans.

Read the full article here: https://www.wsj.com/articles/retirement-funds-bet-bigger-on-private-equity-11641810604